Economic Thoughts (Part 2 - Freight)

I made my original Economic Thoughts post 217 days ago. With the rapid change in both the global consumer markets and the consumer markets here in the USA, it was a good time to revisit and see where we currently stand.

In July 2022, we had just begun to see the first decline in the cost inflation associated with the primary forms of freight transportation. My initial belief was that the deep sea water transportation of freight would continue to drop and continue to do so rapidly as the covid-19 supply and demand crunch began to wane.

The PPI print's freight-related components tell a different story. I want to note that this print has some lag to it. For us specifically, we have seen a drastic reduction in ocean and air freight costs, so I was surprised to see the print in Deep Sea Water Transportation of Freight higher than the last time we discussed.

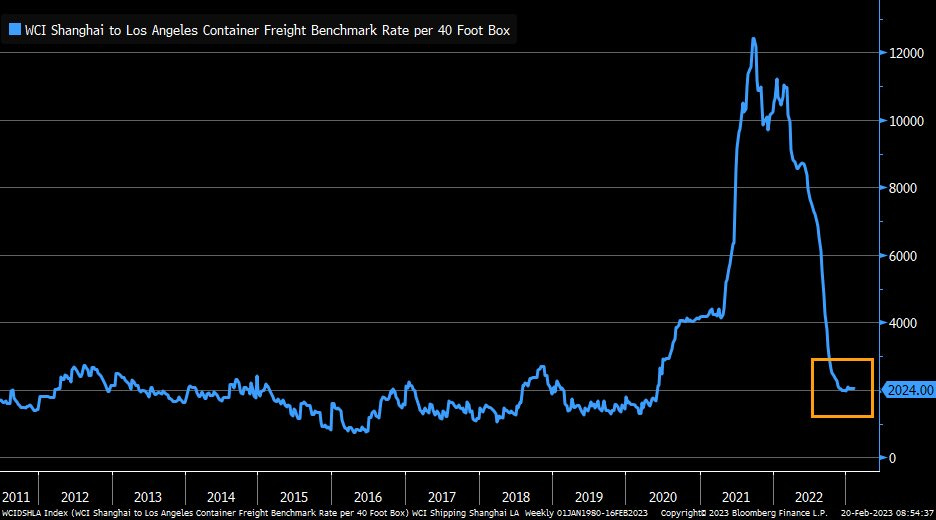

The print below benchmarks the cost to ship a 40-foot box container from Shanghai to Los Angeles, and while this is not our exact route/shipping origin or destination, it paints a picture much closer to what we have seen with our costs. This benchmark is much closer to the mean reversion that I had assumed was coming at some point.

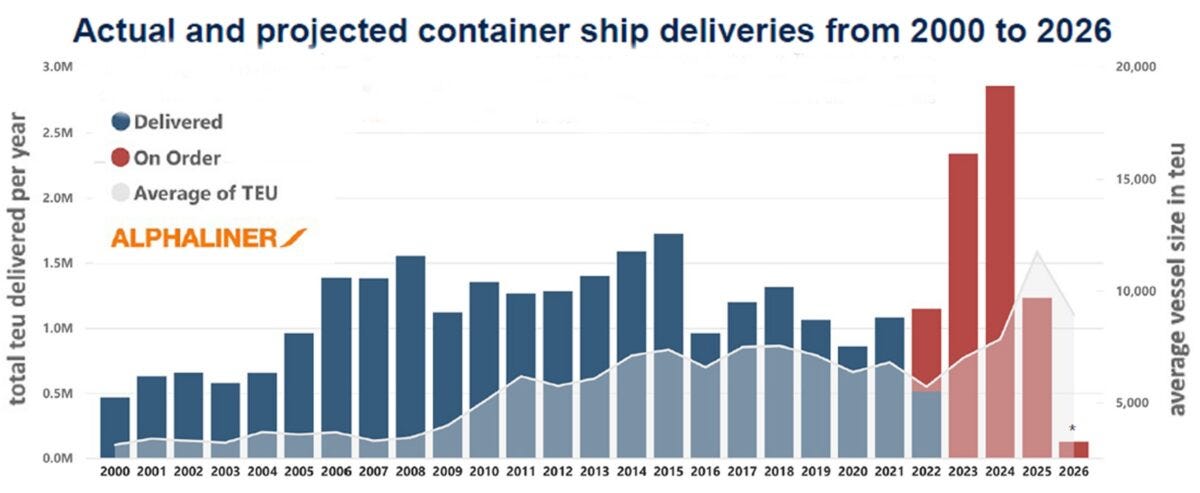

This is an anecdotal point but one worth mentioning (chart below) - there will be a relatively large influx of ship capacity through the next two years seen in the number of ships on the delivery schedule. The newly added capacity could drive prices down even further if there is no demand to fill the excess capacity.

All of the above points to a continual decrease in ocean freight shipping costs, which can potentially be a net positive for the end consumer. The question then becomes - will consumers start to see the freight cost savings passed down from companies in the form of lower prices on everyday goods? After all, freight costs are only part of the overall equation when pricing goods.

I would love to hear from you all - questions, comments, concerns below!

Training

This week's training block was 61 miles with three lifts:

Monday: OFF (Lift - Push)

Tuesday: 7 (2 easy and 5 @ 6:00) (Lift-Pull)

Wednesday: 8 (with 12 x 26 sec hill sprints) (NO LIFT)

Thursday: 8 easy (Lift - Legs)

Friday: 7.7 (trackwork - 12x400m @ 83 seconds) (Lift - Push)

Saturday: 6 easy (No Lift)

Sunday: 16 Long (12 @ 6:45 - last 4 @ 6:15) (No Lift)

This was the 3rd week in a row where I hit the proper pacing on the Sunday 16 miles. That run is getting easier, which is a promising sign of progress. I may race a half marathon or a 10 mile soon. I'd also love to test how fast I can run 1 mile.

Articles I found interesting this week:

I Hired 5 People to Sit Behind Me and Make Me Productive for a Month

World’s Largest Four-Day Work Week Trial Finds Few Are Going Back

Well it certainly would be NICE to see the savings passed to customers 😂

Great read. Lagging economic indicators could drive us into a deflationary environment on top of a FED induced recession.